News & Insights

Blumberg Capital portfolio news, startup growth resources and industry insights

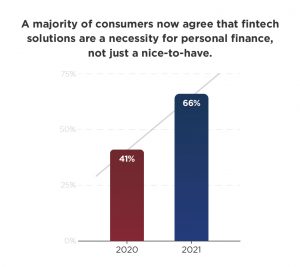

Blumberg Capital’s fourth annual survey of consumer behavior and attitudes on fintech reveals that the majority of consumers (66%) now believe that fintech solutions are a necessity for personal finance, not just a nice-to-have, up from 41% in 2020. Fueling this shift, U.S. fintech startups raised a record-breaking $39 billion in venture capital in the first half of 2021, nearly double than the same period in 2020.

Blumberg Capital’s 2021 survey was designed to better understand how fintech investment, innovation and consumer usage has improved consumers’ financial well-being. Survey findings are now available in “FinTech Innovation: Empowering Consumers, Businesses and the Future Economy.”

Here are a few of the findings:

Fintech adoption is rising and becoming an essential part of consumers’ daily lives. Consumers across age groups have moved past the research and adoption phase of fintech and are more comfortable using new solutions, with over half (54%) of consumers agreeing that managing daily finances is easier because of fintech solutions than it was before COVID-19 lockdowns.

Frequency of fintech solutions usage is up, and the most popular activities show it reaching mass adoption. Consumers’ daily usage of fintech solutions has increased year-over-year with activity focused on basic checking, paying friends and budgeting. Millennials expressed a greater acceptance using fintech solutions to manage investments and credit scores compared to other age groups.

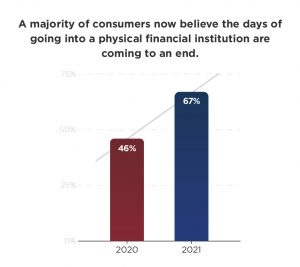

Balance is needed between technology and human interaction. 67% of consumers reported that the days of going into a physical financial institution are coming to an end, up from 46% in 2020. However, 74% of consumers report they have more confidence in employees at banks and stores versus pure technology user experiences, when it comes to managing their personal financial information accurately and securely.

Balance is needed between technology and human interaction. 67% of consumers reported that the days of going into a physical financial institution are coming to an end, up from 46% in 2020. However, 74% of consumers report they have more confidence in employees at banks and stores versus pure technology user experiences, when it comes to managing their personal financial information accurately and securely.

Cost is a key differentiator. When ranking reasons to try a new fintech solution, ‘free’ topped both ‘secure’ and ‘easy to use.’ In addition, 57% of consumers are willing to share more personal information with a financial services provider if it results in additional savings.

Consumers feel more financially prepared than last year. According to the survey, 80% of consumers agree that the latest financial technology will help many more Americans be better off financially by making financial transactions (e.g. payments, e-commerce, investments, insurance) easier and/or less expensive. Further, 79% of consumers agree that traditionally financially underserved people (e.g. those with low FICO scores, insufficient employment history, non-U.S. citizens) need access to credit from banks and non-bank lenders.

“Entrepreneurs rose to the challenges created by the COVID-19 lockdowns by providing consumers and businesses with fintech solutions that expand access, safety, convenience and productivity across a broad array of financial services,” said David J. Blumberg, founder and managing partner at Blumberg Capital. “Rising acceptance and dependence on fintech solutions are creating positive ripple effects throughout the economy. As the role of big data, AI and machine learning in financial services increases, entrepreneurs and the broader fintech ecosystem will benefit from balancing technology efficiency with the human touch.”

The full report is available here.

_______________________________________________________

Learn more about Blumberg Capital’s portfolio of fintech companies.

Related Articles