News & Insights

Blumberg Capital portfolio news, startup growth resources and industry insights

Survey Reveals COVID-19 Rapidly Accelerated Consumer Adoption of FinTech and the Demise of Cash

Nov 17, 2020

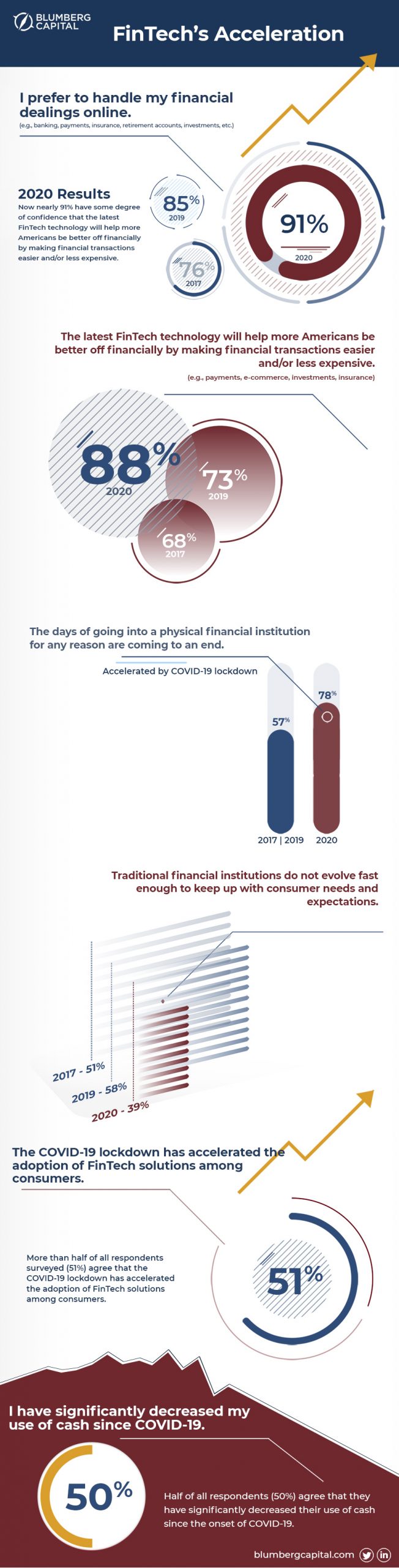

SAN FRANCISCO, Nov. 17, 2020 – Blumberg Capital, a leading early-stage venture capital firm, today announced the results of a survey of consumer behavior and attitudes on fintech. The survey polled 1,000+ U.S. consumers since the onset of the COVID-19 pandemic and the associated conditions of economic lockdowns, social distancing and work from home. The results show that for a clear majority of consumers, COVID-19 lockdowns accelerated their adoption of fintech solutions and for 50% of respondents, it decreased their use of cash significantly.

New digital fintech solutions are meeting much greater acceptance as consumers demonstrate they are ready, willing and able to adopt the new technologies in daily life. Blumberg Capital’s previous fintech survey in 2019 showed that consumer fintech adoption was already rising, and the new reality has fast-tracked adoption with a decisive shift away from cash towards contactless payment and other digital payment methods. COVID-19 was the catalyst for the digitization of financial services that are already providing simple, convenient, safe, secure transactions and higher functionality applications at lower cost.

Additional key insights from the fintech survey include:

- 78% of consumers say that the days of going into a physical financial institution are coming to an end, accelerated by the COVID-19 lockdowns, far higher than the 57% who shared that viewpoint in 2019.

- The bar has been raised for innovation as only 20% of consumers think traditional financial institutions are evolving fast enough to keep up with consumer needs and expectations.

- Almost half of consumers agree that the latest financial technology will help Americans be better off financially.

- Only 9% of consumers do not agree that the latest fintech solutions will help more Americans be better off financially. This is down slightly from 2019 results, when 15% did not agree that fintech helped Americans financially.

- Only 12% of consumers do not prefer to handle their financial dealings online.

Recent industry reports also corroborate these findings. According to Accenture, the total value of fintech investments globally rose 3.8%, from US $22.3 billion to US $23.1 billion in the first half of 2020, even as the COVID-19 pandemic spread around the world. Additionally, CB Insights reports that this number increased another 4% in Q3 2020. This not only includes the massive deals from M&A activity within the industry but highlights the increased interest by investors in early stage companies as well.

The increasing use of fintech applications in daily life is supported by other data on the proliferation of the necessary hardware and network infrastructure. For example, smartphone ownership increased from 31% in 2011 to more than 81% in 2020. In addition, ICBA reported that 64% of American consumers utilize mobile wallets. The findings demonstrate that technological fintech solutions are helping mainstream consumers adapt to rapidly changing demands at work or school, as well as in commerce, recreation and even travel for safety, security, convenience and lower transaction costs. A less obvious benefit for fintech vendors, financial services firms and their customers is the seamless collection of structured streaming data, combined with AI to improve applications and meet changing consumer demands in near real-time.

“The general public is far more receptive and far less resistant to fintech solutions now than ever before and the COVID-19 lockdowns, social distancing and work from home were clearly catalysts that accelerated the rapid broader adoption,” said David J. Blumberg, founder and managing partner at Blumberg Capital. “Fintech entrepreneurs truly rose to the occasion for American consumers by delivering secure, seamless user experiences while expanding access, safety, convenience and efficiency at lower cost. These qualities were ‘nice to have’ before the pandemic but have become necessities in 2020. Looking forward, fintech is part of the new normal, whose influence and reach continues to grow.”

METHODOLOGY

This survey was conducted via Dynata and targeted 1,000 general U.S.-based consumers over 21 years of age.

Related Articles