News & Insights

Blumberg Capital portfolio news, startup growth resources and industry insights

By Jacob Katz, Principal at Blumberg Capital

Over 5 million businesses are started every year in the United States alone, and the majority of entrepreneurs behind these companies do not have a finance background. Business owners often take on unfamiliar finance functions, prematurely hire costly in-house professionals or outsource work to low-tech accounting firms for bookkeeping. Modern, high-growth businesses need better access to finance support that not only helps them track past performance but also focuses on leveraging insights for guiding future business strategy.

Enter: FlowFi

FlowFi combines a comprehensive technology and platform with senior finance experts from industry leaders such as PayPal, Netflix, Headspace and UNREAL Brands to help business leaders operate at peak financial performance. Our team is proud to be FlowFi’s lead Seed investor and be part of their journey to modernize accounting and data-driven insights for entrepreneurs and high-growth businesses.

Led by co-founders Nate Cavanaugh, a repeat founder, and J.J. List, a veteran startup operator and investor, the FlowFi team has already signed on more than 100 customers seeking tools for better financial understanding, management, and planning.

Co-founders Nate Cavanaugh and J.J. List

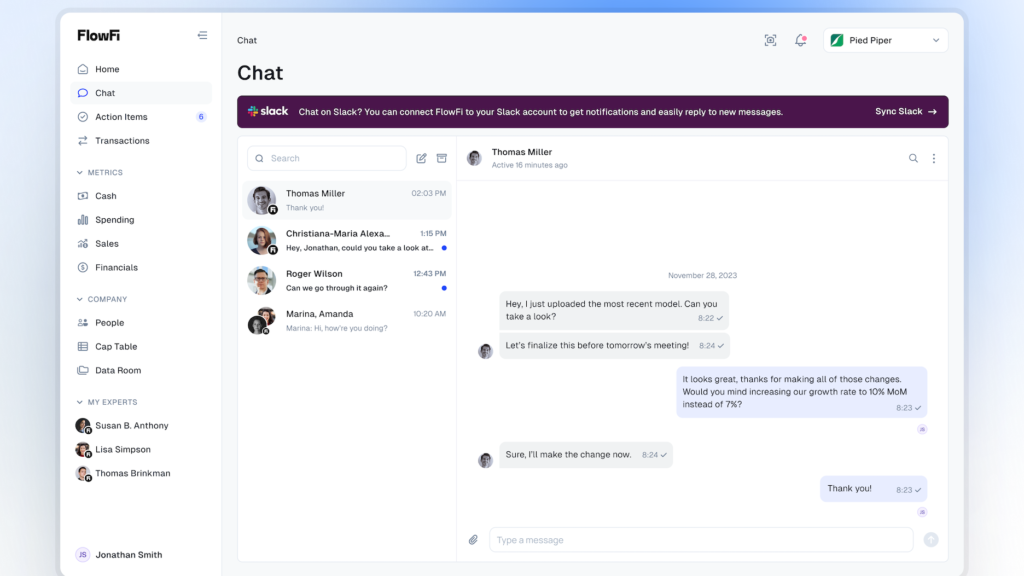

Technology Platform + Data-Driven Expert Advice

Traditional accounting services are often slow and focused on the three standard financial statements — balance sheets, cash flows, and income statements. This is not enough for high-growth businesses who rely on real-time key performance indicators (KPIs) to inform business decisions and strategy. FlowFi brings together a comprehensive technology platform with a network of experienced finance professionals, who use FlowFi’s platform to provide personalized financial services and advisory. At Blumberg Capital we work with high-growth startups every day and see firsthand the value of accurate and accessible data including improved decision making, efficiency of information access, and peace of mind that you know exactly what is happening in real time. We understand the challenges of pure software-only solutions and FlowFi’s scalable platform, combining the experience of experts with integrated software, stood out.

The platform enhances traditional financial statements by incorporating essential non-GAAP financial metrics, such as MRR, ARR, trends in gross margin percentage, vendor expenditure trends, and other key indicators that are often obscured in standard financial reports. These metrics are crucial for operators, but have been disjointed from many businesses’ core financial practice. When we first met Nate and JJ we immediately loved the product. Since then, not only has the team continued to introduce powerful new features that transform how customers manage their businesses, but they’ve also built out a pipeline of exciting capabilities.

Beyond Traditional Bookkeeping

Customers have access to an interactive and sleek online dashboard, where they can connect their financial accounts, such as Stripe, Shopify, Bill.com, bank accounts, credit cards, QuickBooks, and other modern platforms for integrated financial analysis.

The integration between the technology platform plus the expert ecosystem sets customers up to easily access comprehensive finance support. FlowFi’s addressable market in the U.S. is substantial, as it can provide value to the more than 30 million small businesses and growing. Additionally, over time FlowFi can certainly expand internationally as the problems they are solving are not unique to the US or US dollar denominated businesses.

FlowFi is already delivering real value to customers. For example, one customer reported a 10X reduction in their payment collection timeframe that effectively converted their accounts receivable from a financial burden into an asset that enhances cash flow. Customer examples like this are the norm and the vision that Nate and JJ have for the future of the company already resonates closely with the reality of today’s customer experiences.

The Future of Data-Driven Business Operations

Blumberg Capital’s investment in FlowFi aligns with our investment thesis to address real business pain points experienced by large markets, with scalable solutions, and builds on decades of partnering with visionary fintech founders and teams. FlowFi provides customers with critical information and analytics combined with vital accounting and finance services, and their development of a scalable model highlights a commitment to innovation and ensuring growth potential. We look forward to being strategic partners to FlowFi, leveraging our network, extended team, and experience to help accelerate FlowFi’s growth, and to collaborating with co-investors Parade Ventures, Differential Ventures, Precursor Ventures, Special Ventures, 14 Peaks Capital, and Cooley.

We have already seen the impact that FlowFi can have across our portfolio companies and other entrepreneurs in our network. If you’re an investor or founder, we encourage you to learn more about how FlowFi can deliver value to your business. Nate, JJ, and the FlowFi team are committed to a future that merges the best of modern software and skilled professionals, the combination of which modern businesses can trust, allowing them to focus on growing and thriving.

FlowFi team, welcome to the Blumberg Capital portfolio of fintech innovators!

Learn more about FlowFi in today’s TechCrunch article or by visiting FlowFi.com.

Related Articles