News & Insights

Blumberg Capital portfolio news, startup growth resources and industry insights

Investing in Creednz and the Future of Payment Protection

Sep 28, 2023

By Yodfat Harel Buchris, managing director, and Ilia Shnaidman, vice president, at Blumberg Capital

We are pleased to announce our investment in Creednz and its mission to safeguard corporate finance teams from payment scams. Payment fraud amounting to billions of dollars is one of the top risks to companies globally, with more than two-thirds of U.S. corporate finance departments reporting a breach that had a negative financial and reputational impact in the past 12 months. The Miami and Israel-based startup is a groundbreaking company founded to ensure that companies pay exactly who they intend to pay and do not lose a single dollar to fraud.

Co-founders Johnny Deutsch and Moshe Elgressy

Creednz co-founders Johnny Deutsch, former CISO at Rivian Motors, and Moshe Elgressy, a serial entrepreneur with more than two decades of experience building companies in the cybersecurity industry, are technology and cybersecurity veterans with deep domain expertise in corporate cybersecurity. Elgressy’s previous ventures include DataLayers, SecureNative, 7Security, and time at Microsoft.

Deutsch and Elgressy founded Creednz after seeing firsthand the devastating impact that payment fraud can have on businesses.

According to a recent study by Creednz and the Ponemon Institute, 88% of companies have experienced at least one payment transaction fraud in the past two years, with an average loss of $150,000 per incident.

Beyond losing capital, the top negative consequence following a fraud incident is reputational damage to business partners and consumers.

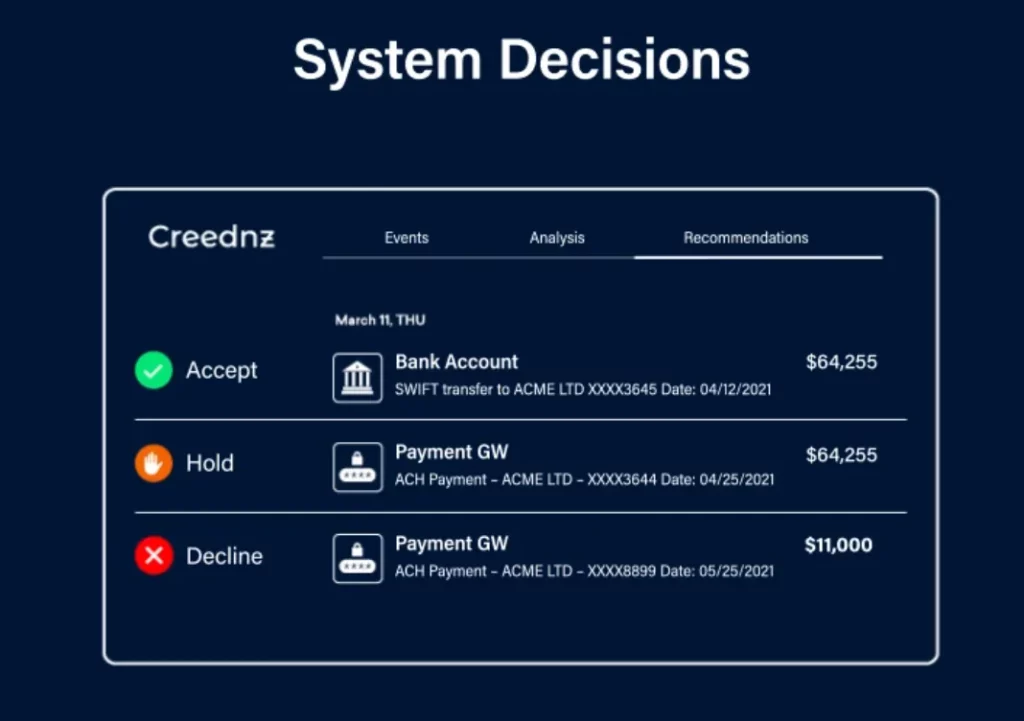

Creednz’s cutting-edge technology proactively identifies and prevents various risks, including internal occupational fraud, omissions, data corruption, and external threats such as vendor impersonation or compromise. The company’s unique approach leverages untapped data sets from corporate finance, such as bank account movements, ERP systems, and purchasing and management systems, to detect and prevent fraudulent activities before they occur.

We invested in Creednz because of its team and technology: groundbreaking solutions, founder-market fit, and strong leadership team. Deutsch and Elgressy’s deep expertise in cybersecurity and financial services gives them a unique understanding of the challenges and intricacies of protecting corporate finances. We believe this inherent knowledge, combined with Creednz’s advanced technological approach, positions the company to revolutionize the financial security sector.

At Blumberg Capital, our investment thesis prioritizes backing visionary founders with transformative tech solutions. Creednz exemplifies this ethos, building a partnership based on values and vision. We look forward to a long partnership with the Creednz team alongside co-investors Elron and Moneta who, like us, recognize and believe in Creednz’s transformative potential.

Team, welcome to the Blumberg Capital family of visionary entrepreneurs shaping the future of cybersecurity and financial services.

Read more about Creednz’s new funding round in Calcalist.

Learn more about the future of financial security and how Creednz can empower your company to stay safe at: https://creednz.com/.

Related Articles